GONDA MORTGAGES

Mortgages Made Simple,

Homeownership Made Possible.

No two homebuyers are the same, and your mortgage should reflect that. With Gonda Mortgages, you get personalized financing solutions, expert advice, and a dedicated partner who truly understands your needs.

Hellen Gonda

Associate Mortgage Broker

License #3000601

Home Builders Nova Scotia

Construction Mortgage

Building a home is a big milestone, and the right construction mortgage ensures a smooth process from start to finish. Unlike traditional home loans, construction mortgages are designed to fund each stage of your build, giving you financial flexibility and peace of mind. With expert guidance and a financing plan tailored to your project, we help you stay on track, on budget, and in control.

Key Benefits

Flexible Construction Financing

Pre-Qualify for a new construction loan. Structured to match your building timeline.

Budget Confidence

Funds released as your project progresses, keeping things on track.

Local Knowledge

We understand Nova Scotia’s housing market and builder requirements.

Expert Support

We understand Nova Scotia’s housing market and builder requirements.

DOWNLOAD FREE GUIDE

New Construction Loan Buyer’s Guide

Your Ultimate Guide to Financing Your Dream Home

Don’t navigate construction financing alone. Our comprehensive guide walks you through.

Understanding construction loan types and how they work

The step-by-step loan process from pre-approval to completion

Budget planning with cost breakdowns

Timeline expectations for your construction project

Choosing between a mortgage broker and bank

Selecting the right builder and avoiding common pitfalls

Download Your Free Guide

Home Builders Nova Scotia

Purchase Plus Improvements

Mortgage Over $40K

Buying a home that needs upgrades? Most lenders cap renovation financing at $40K, but we connect you with specialized lenders who offer more—so you can make the changes you truly want. From modernizing your kitchen to adding more living space, we help you secure the funds to transform your home without taking on costly second loans or lines of credit.

Why Choose This Option?

No $40K Cap

Get the financing you need for major renovations.

Upgrade

Customize your home to fit your lifestyle.

One Simple Mortgage

Avoid the hassle of juggling multiple loans.

Expert Guidance

We’ll help you navigate the process smoothly.

Real estate investors

Investment Properties

Maximize your Real Estate portfolio! As a real estate investor herself, Helen Gonda brings years of practical experience to the table, helping clients navigate investment property opportunities. Whether you’re buying a rental property, flipping homes, or seeking mixed-use properties, we provide expert advice and tailored mortgage solutions to maximize your return on investment.

Guidance based on real-world experience and market trends.

Personalized financing solutions for real estate investors.

Help with multi-unit or commercial property loans.

Insights on the best investment strategies to build wealth through real estate.

New to Canada?

Canada Newcomer Mortgage

Starting fresh in a new country can be exciting but challenging, especially when it comes to securing a mortgage. As an immigrant herself, Helen Gonda understands the challenges firsthand and is here to make the mortgage process simple and stress-free. With expert guidance, personalized solutions, and support in Russian and Ukrainian, we help you navigate Canadian mortgage rules so you can settle into your new home.

Review Your Finances

Review your income, savings, and credit score. Gather documents like pay stubs and bank statements.

Apply for Pre-Approval

Submit an application with a mortgage broker or lender. They’ll review your finances and credit.

Receive Your Pre-Approval Letter

If approved, you’ll receive a letter stating your loan amount and rate, valid for up to 120 days.

Start House Hunting & Finalize Your Mortgage

Start house hunting with confidence. Once you choose a home, complete the mortgage process and get final approval.

Home Mortgage For Self-Employed

Mortgages Built for

Self-Employed Professionals

Being self-employed can make it more difficult to secure a traditional mortgage through major banks. However, there are still plenty of options available! We work with a variety of lenders who specialize in providing mortgage solutions for self-employed clients. Let us help you develop a strategy to qualify for the best rates and mortgage terms.

How We Can Help

No $40K Cap

Get the financing you need for major renovations.

Upgrade

Customize your home to fit your lifestyle.

One Simple Mortgage

Avoid the hassle of juggling multiple loans.

Expert Guidance

We’ll help you navigate the process smoothly.

Work with Helen, you’re Gonda love it!

Build or buy a home

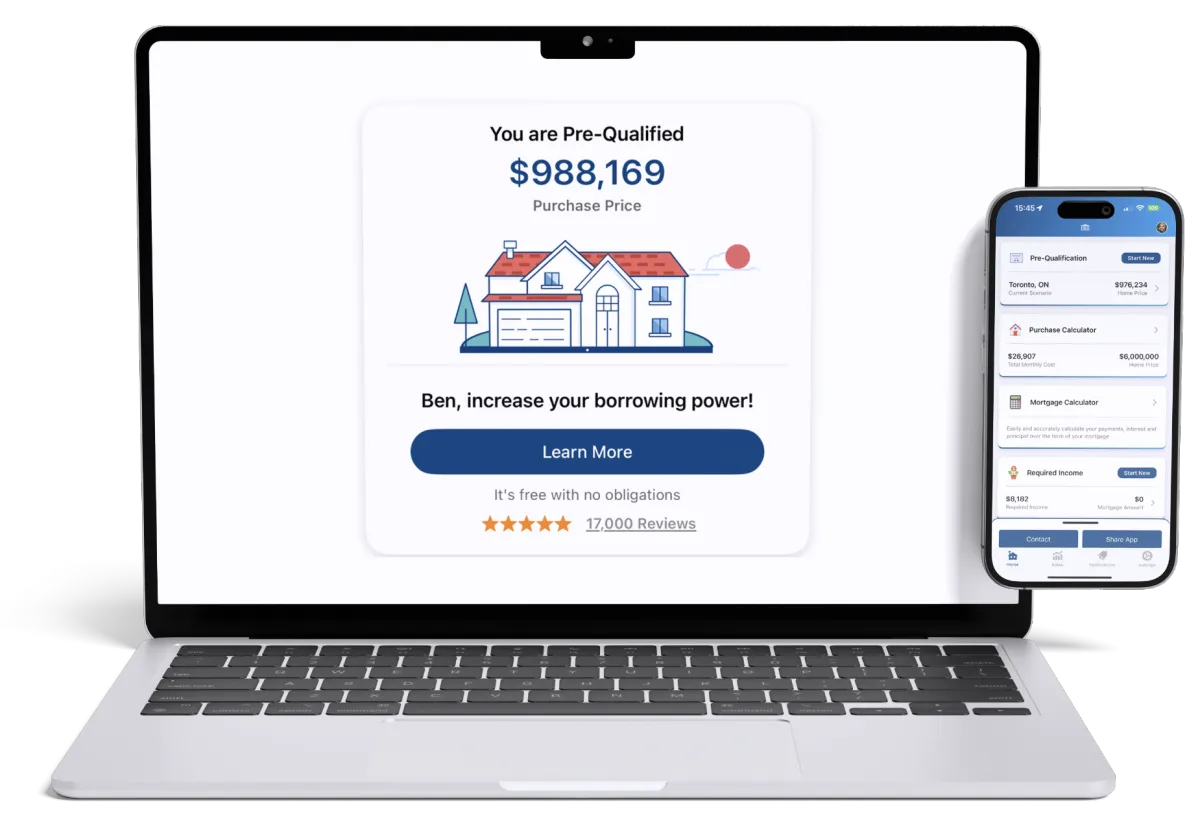

Pre-Approval Mortgages

A pre-approval is a crucial step in the home-buying process, giving you a clear understanding of your budget. With a quick and easy pre-approval process (often in as little as 24 hours), you’ll know exactly how much home you can afford, helping you make informed decisions when house-hunting.

Why Get Pre-Approved?

Quick & Simple Process

Get results fast, often in just 24 hours.

Know Your Budget

Shop for homes with confidence.

Stronger Offers

Stand out in competitive markets with a pre-approval in hand.

Build or buy a home

First Time Home Buyer Nova Scotia

Your First Home, Made Simple

Buying your first home should be exciting, not stressful. We simplify the mortgage process and provide the expert guidance you need to make informed decisions with confidence.

Making Mortgages Simple

We break down mortgage terms, pre-approvals, and down payments so you know exactly what to expect.

Finding the Right Financing

We help you navigate rising home prices and interest rates to secure the best mortgage for your budget.

Helping You Qualify

Our team explores every option, including first-time homebuyer incentives, to maximize your buying power.

No Surprises

We prepare you for all the costs involved—closing fees, taxes, insurance—so there are no unexpected expenses.

Winning in a Competitive Market

We give you the tools and strategies to make strong offers and secure the home you want.

Nova Scotia Down Payment

Assistance Program

Get an interest-free loan of up to 5% of your home’s purchase price to help with your down payment. Eligibility is based on income, credit score (650+), and mortgage pre-approval. Property price limits apply by region.

GST/HST New Housing Rebate

Receive up to $3,000 in HST rebates on newly built homes. Available to buyers who haven’t owned a home in Canada in the last five years and plan to live in the new home.

First Time Home

Buyer Incentives

Claim a $1,500 tax credit (HBTC) and benefit from the GST/HST New Housing Rebate to lower upfront costs on new home purchases.

Build or buy a home

Leverage Your Home’s Equity

for Better Financial Flexibility

Your home is more than just a place to live, it’s a powerful financial tool. Refinancing allows you to tap into your home’s equity to consolidate high-interest debt, fund major renovations, or invest in new opportunities. With lower interest rates than most personal loans or credit lines, refinancing can help you save money while giving you the financial flexibility you need.

Key Benefits

Pay off high-interest debt faster

Lower rates compared to personal loans and credit lines

Finance home upgrades or investment opportunities

Customized loan options tailored to your financial goals

Ready to put your home’s equity to work?

Let’s explore your refinancing options today!

PRE-APPROVAL APPLICATION PROCESS

Build. Buy. Invest.

Get Pre-Approved Today!

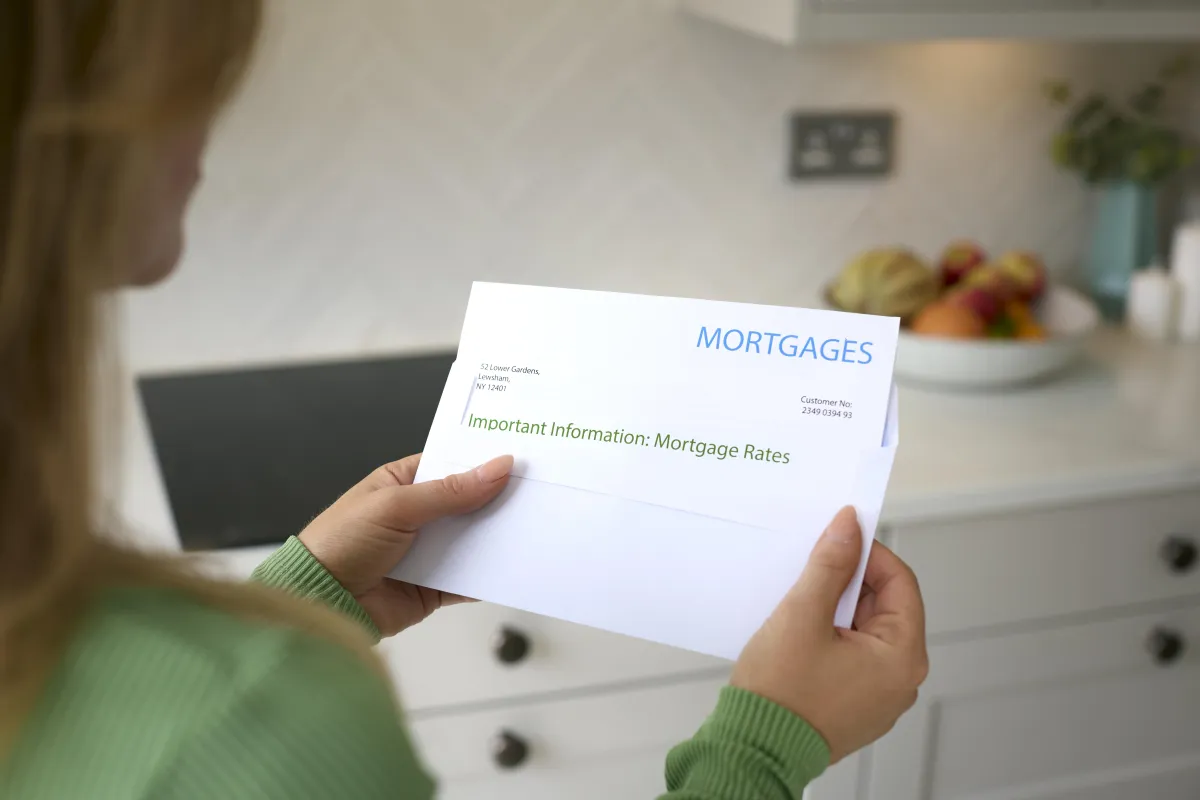

Mortgage Rates In Nova Scotia

Don’t settle for your bank’s first offer, there are better deals out there! Many homeowners unknowingly pay more by automatically renewing without comparing options. We’ll help you secure the best mortgage prices by shopping around for lower rates and better terms, ensuring your mortgage works for you, not the other way around.

Save More Over Time

Lock in a lower rate and reduce interest costs over the life of your mortgage.

Expert Guidance

Support in understanding Canadian mortgage rules and regulations

Access to the Best

Mortgage Prices

We compare multiple lenders to find you the most competitive deal.

PRE-APPROVAL APPLICATION PROCESS

Mortgage Renewal Process and Tips for Your Best Rate in 2025

4-6 Months

Start reviewing mortgage renewal rates.

1-4 Months

Reserve a rate and monitor for a lower rate.

2 Weeks

Final rate drop, final preparations to renew.

Finally

Renewal happens smoothly and on time.

Your renewal is the perfect time to reassess and save.

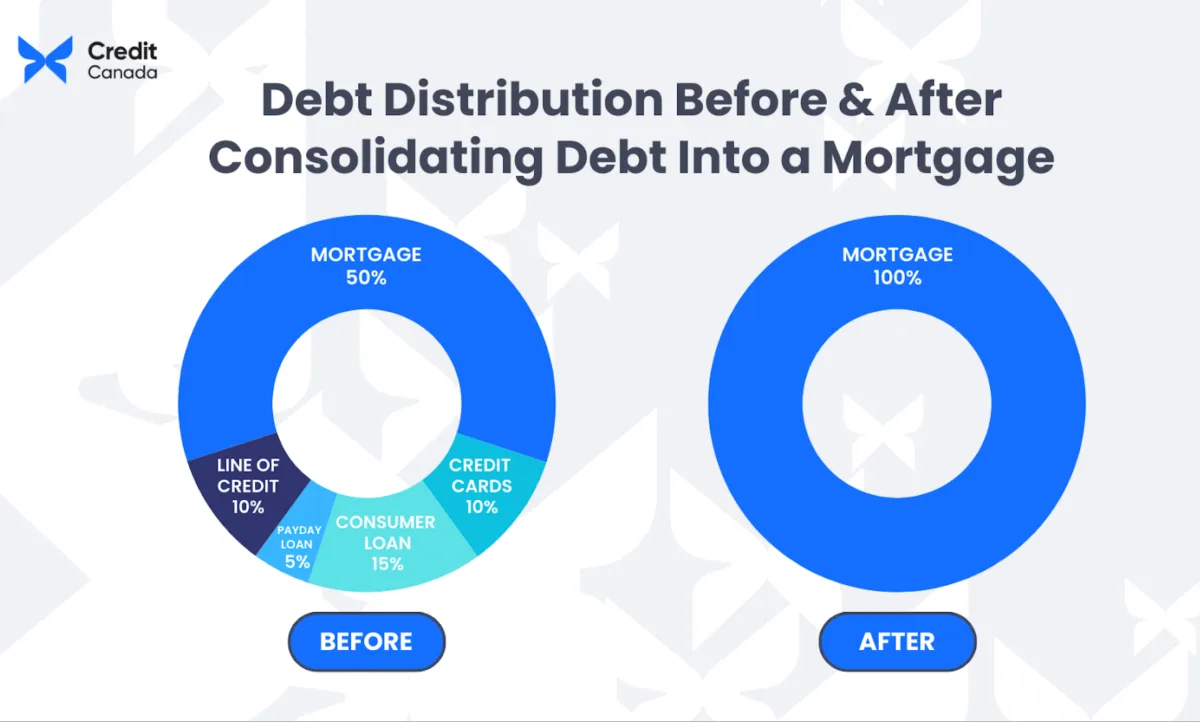

Bad Debt Consolidation Mortgage

Take Control of Your Debt

with Smart Mortgage Solutions

If you’re juggling high-interest debt, such as credit cards, personal loans, or lines of credit, consolidating these debts into your mortgage could significantly lower your monthly payments and save you thousands in interest. Let us show you how debt consolidation can help you take control of your finances and avoid the stress of consumer proposals or bankruptcy.

Key Benefits

Avoid Financial Hardship

Prevent the need for consumer proposals or bankruptcy

Lower Monthly Payments

Lower monthly payments by consolidating high-interest debts

Save On Interest Rates

Secure a lower rate and pay off your debt faster.

Simplify Your Finances

Simplified financial management with one monthly payment

Commercial Mortgage Broker

Nova Scotia Commercial Mortgages

Financing for Commercial Properties and Mixed-Use Buildings

Expanding your real estate portfolio, generating rental income, or securing a space for your business requires the right financial strategy. Commercial and mixed-use properties come with unique lending requirements, and navigating the process can be time-consuming and complex. That’s where we come in.

At Gonda Mortgages, we simplify commercial financing by connecting you with lenders who understand your investment goals. Whether you’re purchasing, refinancing, or developing a property, we provide the expertise to structure a loan that works for you.

How We Help You Succeed

Specialized Lending

Solutions

Specialized loans for commercial and mixed-use properties

Expert Guidance on

Documentation &

Negotiations

We handle the paperwork and work with lenders on your behalf to strengthen your application.

Higher Approval Odds

With our experience and lender relationships, we help position your application for success.

Access to Competitive

Rates

Get the best possible terms to maximize cash flow and profitability.

Real estate is a long-term investment—let’s make sure you have the right financing to grow with confidence.

Canadian Armed Forces Mortgages & Relocation

Helping Military Families Secure Homes with Ease

Frequent relocations, tight posting deadlines, and securing housing on short notice can make homeownership stressful for CAF members. At Gonda Mortgages, we understand the demands of military life and are here to simplify the mortgage process for you.

We offer exclusive mortgage discounts for CAF members and work quickly to ensure you’re pre-approved, find the right home, and close on time. With years of experience assisting military families, we collaborate with local realtors who specialize in military relocations to get you the best deal without the hassle.

How We Help CAF Members

Exclusive Discounts

Discounted mortgage rates for CAF members

Military Relocation Expertise

Specialized knowledge of military relocation and posting season timelines

Fast & Stress-Free Pre-Approvals

Get approved quickly so you can focus on your move.

Local Realtor Partnerships

We connect you with experts who specialize in military relocations.

Real estate is a long-term investment—let’s make sure you have the right financing to grow with confidence.

All Medical Professions

Mortgages for Medical Professionals & First RespondersHomes with Ease

As a medical professional or first responder, you dedicate your career to helping others, let us take care of your home financing needs. Whether you’re a doctor, nurse, paramedic, firefighter, or police officer, we offer specialized mortgage solutions tailored to your unique income structure, student debt considerations, and career stability. With access to exclusive lender programs and competitive rates, we make homeownership easier for those who serve our communities.

How Gonda Mortgages Can Help

Exclusive Mortgage Programs

Special financing options are designed for healthcare workers and first responders.

Higher Borrowing Power

Lenders recognize your earning potential, allowing for flexible approval terms.

Low or No Down Payment Options

Cash-back offers for medical professionals and first responders

Student Debt Consideration

Get approved even with existing student loans.

Priority Approvals & Fast Closings

Streamlined process to fit your busy schedule.

Let us simplify your mortgage process so you can focus on what matters most—your career and family.

Contact us today to explore your best mortgage options!

Testimonials

Don’t take my word for it,

Hear from my clients.

Are you purchasing, refinancing or have a mortgage renewal coming up and you need a Mortgage Broker who knows what she is doing? Start the process today by applying to my online application.

As a financial advisor, I’m trusted to provide the right recommendations and introduce my clients to the right professionals to help them reach their goals.

Helen is a mortgage broker I often refer my clients to as she is incredibly knowledgeable and has a great deal of care for her clients. I can always trust Helen to take as good of care with my clients as I do myself.

Michael K.

Halifax NS

Helen is a fierce professional who's knowledge and no nonsense approach will help you feel assured you are getting the best solution for your needs. My partner and I LOVED working with Helen Gonda, she's a gem and she'll help you find a great solution too!

Fran Dunn

Halifax NS

Helen is a seasoned mortgage broker. She will guide you through the process of getting the perfect loan. But also she will help you planning and enhancing your credit score. She will help you choose the perfect lender according to your needs and situation.

Ismael H.

Halifax NS

Let’s Build Your

Future in Nova Scotia

Every homebuyer and investor has unique goals. I’m here to find the mortgage that fits yours. With expert advice and a deep understanding of Nova Scotia’s market, I’ll help you take the next step with confidence.

Let’s Talk!

Work with Helen, you’re Gonda love it!

Build, Buy, & Invest

We’ve Got You Covered!